The enormous popularity of trading is gaining momentum around the world. A few years ago this concept did not have the same significance as it does now. Trading has been known among professional economists and marketers for a long time, but only now this field of activity is in great demand. It is worth noting the fact that the population of European countries earns a lot of money on the stock exchange. Successful activity depends on many factors, operating principles and methods that are used in this direction. The right path will require special knowledge and skills. Leverage allows you to carry out trading operations with large deposit amounts. In simple words, leverage is borrowing funds that can be used for their intended purpose to increase profits from deposits. The exchange provides players with enormous opportunities.

If a person does not have the required amount of funds on his own deposit to carry out financial transactions, he can borrow the required amount from a brokerage company. This allows you to open large positions. You can find out what leverage is from relevant literature, special training programs, online lessons and courses. Forex leverage is a beneficial tool for all parties involved in currency trading. Now this opportunity is perceived by participants as a great chance to start successful trading without having large personal funds. Experienced players know what leverage is and how to use it correctly. Proper use of virtual funds provided by brokers can bring decent income. Forex leverage allows participants to operate funds in order to increase your capital.

Leverage is an additional opportunity

Today, forex leverage is an interest-free loan provided by brokers for trading processes. The tool makes it possible to attract new players with small deposits to participate in transactions. You will be able to trade with small funds on par with decent institutions. Leverage means additional opportunities, new levels of earnings on Forex and participation in trading. Varieties of trading allow you to choose the best options for players. You can use financial leverage in certain cases:

- aggressive trading style, which ensures rapid deposit acceleration;

- when opening a large number of forex orders, a deposit will be required;

- strategic investment, the selection of minimum loan indicators occurs.

Any trading with leverage can ensure successful trading if you use the opportunities provided wisely and correctly. The ideal option when choosing leverage is to calculate all the risks and determine the outcome you need. Inexperienced beginners try to keep up with the enormous opportunities, but forget about the possibility of financial “merging”. You need to clearly understand what leverage is in Forex and know all the features of this instrument.

- Choose an exchange that offers maximum Forex leverage.

- Explore different platforms, trade on demo accounts.

- Try to place a bet where the amount is greater than your deposit.

- Wait until all bets are closed and analyze the results.

Forex leverage has its own prospects and such an offer looks very attractive to trading participants. But don’t rush, carefully weigh each step and analyze the market situation. Only with full confidence in your abilities and the right strategic direction, begin to take advantage of all market opportunities.

Forex leverage, features and benefits

Lending is a very profitable exchange instrument and has a lot of advantages and disadvantages. Leverage in Forex allows you to increase your deposit and make quite profitable trades. Let’s highlight the main positive aspects:

- insignificant losses when compared with income;

- the ability to place bets, the price is higher than the account on deposit;

- increasing the contribution by a couple of times with minimal waste of time.

Forex leverage also has another side – incorrect identification of pairs of monetary units can lead to loss of deposits in a short period of time. Therefore, competent players place bets whose amount will not exceed ten percent of the deposit. This will save you from unnecessary losses. Wikipedia gives a clear definition of what leverage is in Forex and helps determine further actions in the field of financial relations in the currency market. Always listen to the advice and recommendations of knowledgeable people who have spent many years trading and have made a fortune in speculative market activities.

- limit your losses due to low levels;

- set stops, they will significantly reduce your losses and protect your funds;

- minimize losses and save deposits for subsequent entries, do not get rid of unprofitable positional directions by reducing rates;

- Be careful when using high leverage in Forex;

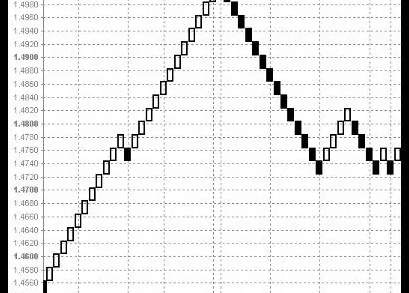

Successful growth is closely related to learning the principles of trading and understanding how leverage differs from other trading tools. Learn to use forecasts correctly when choosing currency pairs and study all the analytics for these monetary units. The market will not tolerate incompetent deposit management and will react very painfully to the chaotic approaches of participants. Use leverage in Forex consciously and choose suitable pairs at a given time.

Conclusions

The main thing that is important to know when using forex leverage in operations is the fact that leverage can be different. Leverage sizes depend on specific instruments (Rumus, Metatrader and others) and their liquidity, and not on the wishes of brokerage companies. When working with assets, you need to keep in mind that conditions may vary. It is important for all participants to know how leverage works in Forex and discover new ways to make money. Let’s consider two options for interacting with brokerage companies.

- Buy cheaper, sell more expensive. The participant analyzes the market, chooses a profitable strategic direction, gives collateral to the brokerage company and asks for leverage to carry out transactions.

- More difficult than the first option, making money on quotes that are falling. Suitable for experienced players.

Trading operations can be carried out according to various strategic developments. Beginners do not need to take risks and take a large leverage; start with small amounts of money so as not to lose all your funds. There are strict rules, it is important to always adhere to them:

- These are not your finances and in fact are for personal assets. The participant works with what he does not have (an artificial booster).

- This is just a lever, not a means, but a tool for activity. It must be returned to the brokerage company at the end of transactions.

- Do not use large amounts at once.

- If the result is negative, your personal account will be depleted quite quickly.

What leverage is in Forex can be found out in detail on specialized websites. There is no need to avoid borrowing money; this is normal practice. You need to understand what leverage does in Forex in order to navigate this market activity. Calculate all situations and start increasing your capital. Learn new approaches, new techniques and develop in your chosen direction. Earn money and find other ways, methods and directions today. There is enough information to acquire skills, knowledge and abilities in the market field. Do not stop at the results achieved, always strive for new heights.