Nowadays, everyone who deals with currencies should understand what currency risk is and how to take it into account. This issue is of particular importance due to the fact that in modern conditions not only commercial organizations, but also individuals are exposed to currency risks. First of all, this is:

- importers;

- exporters;

- banks;

- creditors;

- borrowers;

- currency speculators and so on.

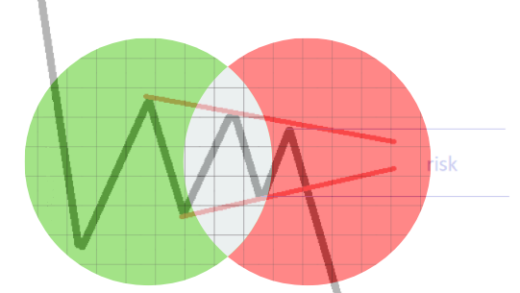

Currency risk is the probability of experiencing a loss

If we talk about risk, then the uncertainty of the final result is already implied. When working with currency, the risk component increases many times over. That is why such a concept as currency risk was introduced. This concept means that there is a possibility of a loss as a result of the currency exchange rate changing. It does not matter in which direction the exchange rate changes:

- A financial loss to the exporter may occur as a result of a depreciation of the payment currency.

- The importer risks losing part of the profit or incurring a loss if the payment currency rate increases.

- As a result of foreign exchange transactions, a trader may receive a loss, both when the currency exchange rate rises and when it falls.

The probability of such losses is an objective reality that must be taken into account. Therefore, it is generally accepted that currency risk is one of the most important indicators in the work of commercial organizations and individuals.

Types of currency risks

In modern economic theory, currency risks are conventionally divided into the following types:

- Operational currency risk. This type of currency risk can arise during trade and financial transactions related to investment (long-term lending). Possible lost profit or loss arises as a result of a temporary gap between the date of the trading transaction and the date of transfer of money for it in foreign currency. If at the time of transfer of money there is an unfavorable exchange rate gap, then the amount of revenue will be significantly less than what was expected to be received in accordance with the initial calculations.

- Translational risk. Sometimes this type of currency risk is called balance sheet risk. This is due to the fact that in this case we are talking about recalculating the amount available on the balance sheet of an organization or commercial company from one currency to another. For example, such a recalculation may be performed to determine the borrower’s foreign currency debt. If the exchange rate of a foreign currency has changed, the result may not be in favor of the company that borrowed the currency.

- Economic risk. Currency risk of this type manifests itself if exchange rate fluctuations in foreign currency affect the economic condition of a business entity. For example, a company uses imported raw materials to manufacture its products. If the price of these raw materials begins to rise, this will cause an increase in the price of the final product, a decrease in the competitiveness of the enterprise and a deterioration in its economic performance.

It should be noted that this classification is valid for enterprises whose main activity is not foreign exchange transactions. Such operations are carried out by commercial banks. Therefore, the bank’s currency risks need to be discussed separately.

Bank currency risk

Commercial banks are active participants in the foreign exchange market. They regularly purchase and sell foreign currency:

- If a bank enters the market with the intention of buying foreign currency, then it has requirements for the transaction to purchase the required amount of currency.

- When selling currency, the bank undertakes to provide a certain amount of currency to the counterparty within a specified time frame.

If there is parity between the bank’s requirements and obligations, its currency position will be considered closed. If there is an imbalance in the requirements and obligations of a participant in the foreign exchange market, then the bank’s foreign exchange position will be open. Understanding this is particularly important due to the fact that currency risk and currency position are interrelated concepts.

With an open position, the bank’s currency risk becomes greater, since it may be influenced by various market and non-market factors. There are several types of currency risks associated with a currency position:

- Exchange rate risk. Negative dynamics of the foreign currency exchange rate until the currency position is closed can lead to significant losses for the bank.

- Interest rate risk. This type of risk is associated with possible changes in interest rates on open currency positions.

- Credit risk. This risk of financial loss arises in the event of failure to repay an open position by one of the parties to the transaction.

- Sovereign risk. This is the risk that there will be interference in the operation of the foreign exchange market by a government regulatory body. The possibility of such interference exists, and it can lead to negative consequences in the work of any commercial bank.

Currency risk in international payments also falls on the shoulders of commercial banks. Therefore, for their part, they are doing everything possible to reduce the risk component in working with foreign currency. This issue should be given increased attention by all business entities that carry out transactions with foreign currency and depend on its exchange rate.

Currency risk and methods of its regulation

In a free market, currency risk will be present in all transactions involving a particular currency, since its exchange rate is unstable. What needs to be done to minimize this risk, and what methods exist to regulate it?

Currently, there are many techniques, the use of which can significantly lower the level of currency risk. Conventionally, they are divided into two large groups:

- Internal. Risk management practices within one enterprise or company will be considered internal. They may consist of the following organizational actions:

Close the currency position to purchase the desired currency in an amount that allows you to enter into long-term export and import contracts.

Make proactive price adjustments (in national currency) for manufactured products, taking into account exchange rate fluctuations in the foreign exchange market.

Carry out diversification at the stage of signing long-term contracts. That is, contracts must be signed with the possibility of their execution in different currencies that have different trends in exchange rate changes.

Use a currency clause when concluding a contract. In practice, the currency clause is of two types, and contains the following information:

In all settlements between the parties, use only “hard” currency.

When making payments, review the contract value taking into account changes in the exchange rate of the currency agreed upon by the parties. - External. External risk management methods include the following:

Urgent foreign exchange transactions on interbank markets or exchanges. These can be futures, forwards or options contracts.

Insurance. This risk management method is most widely used in practice. To implement it, financial transactions are carried out to compensate for possible losses from unfavorable changes in the exchange rate. Such operations include:

Hedging operations, which most often come down to opening forward currency transactions.

Forex currency swap or two identical, but oppositely directed transactions with different execution dates.

Netting. This is a method of minimizing the number of foreign exchange transactions due to their consolidation.

Acceleration or slowdown of payments in foreign currency during periods of strong volatility in the foreign exchange market.

There are other methods for regulating currency risks. It doesn’t matter which of these methods you use in practice. The main thing is that the effect of such regulation be greatest.