More than $5 trillion worth of stock options, index options and stock index futures expire today. In addition, the S&P 500 and Nasdaq-100 will be rebalanced on the same day

More than $5 trillion worth of stock options, index options and stock index futures expire today. In addition, the S&P 500 and Nasdaq-100 will be rebalanced on the same day

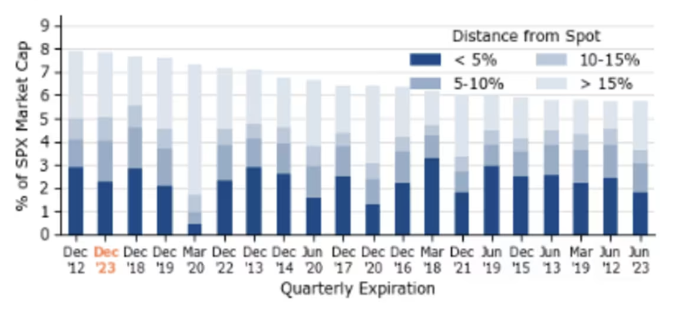

The redemption volume reaches 8% of the SPX market capitalization. This is the maximum since 2012. Source: Google

Analysts warn that events could move quickly and volatility could be off the charts as billions of dollars worth of contracts and securities change hands on this day. The face value of options expiring today is $5.3 trillion, with the largest redemptions taking place before the start of the American session.

On the one hand, many traders will take profits on bullish positions, but some will choose to roll them over to the next period to maintain risk hedging. Index fund managers will have to complete adjustments to their holdings before the announced index changes take effect.

Trading volumes have been growing since the beginning of the week. On the American stock market, stock trading volume reached $17 billion, Steve Sosnick, chief market strategist at Interactive Brokers, said this during a telephone interview with News. For comparison: on Tuesday, trading volume did not exceed $10.6 billion.

“Tomorrow the volume of trade in popular categories will be huge,” Sosnik added. “This is the largest option expiration of the year, which is understandable, December is always like this. But that is not all. Today’s event will likely be the largest redemption of SPX options in the last ten years,” Fishman said in comments to MarketWatch.

Brent Kochuba, founder of options market analytics platform Spotgamma, went even further, saying “this is the largest options redemption ever.”

There is a distortion in the market

Traders were buying bull options at a record pace amid surging markets, according to data from Cboe Global Markets, the largest operator of options exchanges in the United States. Trading volume in S&P500-related options reached 4.8 million contracts on Thursday, surpassing the previous all-time high reached on November 14, according to Cboe. Additionally, total trading volume in call options on all U.S. stocks topped 30 million contracts on Wednesday, marking the strongest bullish contract activity this year, according to Goldman Sachs Group.

Aggressive stock buying over the past month has helped push the S&P 500 close to an all-time high (based on closing prices), options market experts say. The S&P 500 SPX rose 8.9% in November, which was the best month of 2023 of the year and the eighteenth-best month in the last 73 years. It continued to rise in December, according to FactSet data. Since the beginning of the month, the index has risen by 3.3%.

Earlier this week, analysts warned that markets could face trouble as the S&P 500 approaches the 4,600 level. They explained that a “wall” of open interest in call options near that level could force market makers to put the brakes on the rally. However, traders knocked down that wall and pushed the index to 4700. The S&P 500 closed at 4719.55 on Thursday, its highest close since Jan. 12, 2022, according to FactSet data. The index is currently within 1.75% of its record close set on January 3, 2022 at 4796.56.

Traders’ bullish sentiment recently helped push the Cboe VIX volatility index, also known as Wall Street’s “fear gauge,” to multi-year lows.

It’s not just options and S&P 500 contracts tied to popular stocks like Tesla Inc. that generate volume. Call options trading volume tied to the iShares Russell 2000 ETF IWM (which tracks small-cap companies in the Russell 2000 Index) reached 1.35 million contracts, the third-highest ever, according to Goldman. Activity in options contracts related to small-cap stock indexes has been increasing since late October.

Heavy call option buying has driven the S&P 500 put-call ratio to its lowest level in a year, according to Goldman Sachs Group. This suggests that investors were buying up bullish contracts but avoiding bearish ones due to the sustained rise in the stock market. Goldman analysts are calling Friday “the last big event of the year.”

A unique coincidence of circumstances

“Triple Witching Friday” or “Witch Friday” happens once a quarter. On this day, futures on stock indexes, as well as options linked to individual stocks, ETFs and indices, expire. Experts note that they are usually characterized by more intraday fluctuations and higher trading volume.

This time the S&P 500 and Nasdaq-100 will be rebalanced after the markets close on Friday. This is typically a routine event, but it came into the spotlight this quarter because funds were forced to rebalance over the summer to limit exposure to large-cap Nasdaq-100 stocks.

Earlier this month, Standard & Poor’s announced its rebalancing plans, which included reducing the weighting of shares of Apple Inc and Alphabet Inc. GOOG, -0.57% GOOGL, -0.48%. At the same time, Amazon’s share. com will be increased. Three companies, including Uber Inc, will also join the index, while three others will leave it.

Kochuba believes this Friday’s expiration could remove the final barrier holding stocks back to record highs for the rest of the year.

“After OpEx, markets will no longer be held back,” he noted. OptionMetrics’ Garrett DeSimone cautioned that investors shouldn’t put too much weight on options market activity and other technical factors.

“At the end of the day, it’s all about macroeconomics,” he told News.