Main

- – The risk-reward ratio is a coefficient designed to calculate the potential profitability of a trading transaction relative to the inherent risk and taking into account the trader’s strategy. RR will allow you to understand whether the transaction is profitable or not.

- – The risk/reward ratio is calculated after drawing up a trading plan, determining entry and exit points, and setting a stop loss level.

- – The risk/reward ratio is calculated individually for each position based on the trader’s trading strategy, taking into account statistics and opportunities.

- – A good risk-to-reward ratio allows you to earn in the long run with a correct analysis of the results of your trading strategy.

What is Risk Reward Ratio (RR)

The ratio of risk and profit (Risk / Reward Ratio or RR) – a ratio showing the ratio of risk to potential profit. A specific RR value is calculated before buying an asset and allows you to assess the potential of the transaction in terms of the trader’s trading strategy.

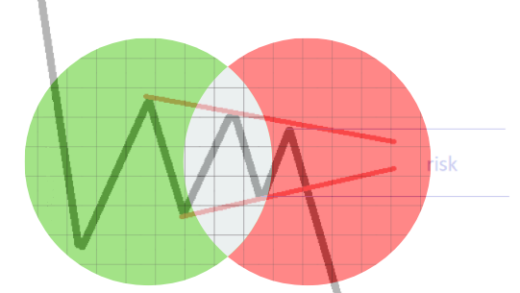

If the risk to reward ratio is greater than 1, then the risk is greater than the potential reward. When the value is below one, then the potential profit is greater than the inherent risks.

In terms of trading and investing, risk refers to the potential loss that a trader is willing to take when opening a position. The level of risk is usually controlled by placing Stop Loss orders, that is, applications for the automatic sale of an asset when a certain price is reached. This is an important trading tool, and it is necessary not only to limit losses. The level of risk is an integral part in the process of calculating the potential profit of a trader and his trading strategy as a whole.

Profit is the difference between the purchase price of an asset and the price at which it will be sold. In the context of the RR ratio, profit is the potential level that a trader determines before entering a position to assess the potential of a trade operation.

How to correctly calculate the risk-to-reward ratio

The generally accepted version of the calculation of the RR ratio is defined as the ratio of risk to reward, that is, RR equal to risk divided by profit. Although some traders, due to personal preference, may use the reverse option, where profit is divided by risk, we will consider a standard calculation example, according to the formula below:

For example, that you want to buy an asset at a price of $100. You also decided to limit your risk, that is, put a stop loss at $90, and set a target price for yourself to sell the asset at $130. In this case, the ratio of RR will be 1 to 3, or a coefficient with an approximate value of 0.33. That is, the risk is less than the potential profit.

In the example with the same entry price ($100) and the same target price ($130) but with a stop loss of $40, the RR ratio would be 2. This ratio would indicate that the risk significantly exceeds the expected reward.

Optimum risk/reward ratio

One of the most popular values when calculating the ratio of risk and reward is 1 to 3 or a ratio of 0.33. Ratios of 1 to 7, 1 to 10, 1 to 15 are also often used.

However, the choice of generally accepted RR options is a gross mistake in trading. The trader himself must determine which RR ratio is best suited for his trading strategy based on experimental data, statistics, and market conditions.

For example, if a trader makes only 50% of successful trades, then RR equal to 0.5 or 1 to 2 will not bring any benefit. The target selling price of an asset before entering a trade should statistically bring profit to the trader, and not just specifically in this trade operation.

In the example with a ratio of 1 to 3 or a ratio of 0.33, the meaning of RR is that one profitable trade can cover 3 losing trades. In the case when the ratio is 1 to 5, then one profitable transaction will have to cover 5 unprofitable ones.

Before assessing risks and making RR calculations, a trader evaluates the potential for price movement, finds an entry point and makes a forecast for the movement of the price of an asset, also determining the moment for exiting a position.

Only then does it make sense to calculate RR. If the resulting coefficient corresponds to the trader’s trading strategy, then he enters the position.

Why Calculate Risk Reward Ratio

RR is calculated so that the trader can effectively use his trading strategy, adjusting the desired level of risk and profit to generate income over a long period of time.

Even if the percentage of successful trades is small, say 20%, then a competent risk-reward ratio can bring a trader income in the long run.

Conclusion:

What is the reward to risk ratio?

The Risk/Reward Ratio or RR is a way of assessing the potential of a trade for a trader based on their trading strategy and capabilities. Simply put, RR shows whether a trade is profitable or not based on potential risk and reward.

What is win rate in trading?

Win rate in trading is the ratio of the number of profitable trades to losing trades. For example, if you close 60% of trades with a profit and 40% with a loss, then your win rate will be 0.6 to 0.4, or 1.5.

What is 1 to 3 in trading?

1 to 3 in trading is one of the most popular reward to risk ratios among traders. It means that at least 1 out of 4 trades must be profitable. However, this ratio should be consistent with the chosen trading strategy and correlated with the win rate. In some cases, the optimal ratio of profitable trades to losing trades may differ.

What is RR in trading?

RR in trading is an abbreviation of the English term Risk / Reward (Risk / profitability) and means the ratio of profit to risk.