What is Pump & Dump?

Pump and Dump is a manipulative scheme to increase the cryptocurrency exchange rate with a subsequent price collapse. Large owners of assets artificially increase (“pump up”, pump) their value in order to subsequently sell (“dump”, dump) it is as expensive as possible for small traders. As a result, the value of the asset decreases, and investors lose funds.

The pump & dump scheme originated in the securities market long before the advent of cryptocurrencies. The first documented episode of such fraud was the scam of the British trading company of the South Seas, which at the beginning of the XVIII century inflated the stock price with false promises of profit. This led to the emergence of the so-called South Sea bubble.

Subsequently, pump & dump was widely used in the American market of “junk” or “penny” stocks (cheap securities with low market capitalization) during the Great Depression in the late 20s – early 30s of the XX century. Then brokers sold cheap shares to each other, which led to an increase in demand and an increase in prices, after which the shares were thrown onto the public market. In the United States, such a practice has been declared illegal. The heyday of pump & dump schemes on the stock market occurred in the early 2000s.

Pump & dump has migrated to the cryptocurrency market in an almost unchanged form. This was facilitated by the lack of regulation. Currently, there are about two thousand “junk” cryptocurrencies. Messengers and social networks have a huge audience, so the pump & dump scheme is extremely popular in the crypto market.

Tens of thousands of pumps have been held during the existence of cryptocurrencies. According to experts from Imperial College London, at least two fraudulent schemes of this kind are implemented every day, and the monthly profit of the organizers is on average $ 7 million.

How does Pump & Dump work?

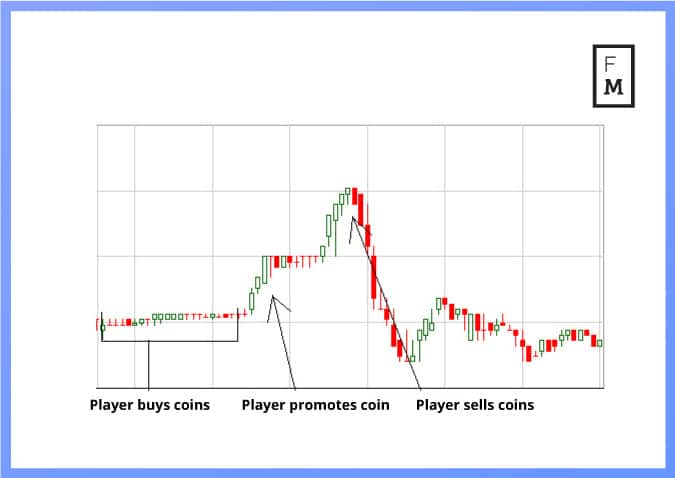

By choosing an exchange and a coin, the organizers buy tokens in small portions so as not to provoke a premature increase in the exchange rate. As a rule, these are little-known cryptocurrencies with low capitalization, popularly known as shitcoins. Sometimes relatively large cryptocurrencies are also used for pump & dump.

After buying the token, the pump begins – its “pumping”. Messengers, news feeds, social networks and exchange chats announce the rapid growth of the exchange rate and inform the name of the exchange platform, where the organizers of the scam place and take large orders for the purchase of a token through their bots, raising its quotation. This is the first wave of the pump.

Most major bitcoin exchanges restrict such activities, and the coins in their listing are rarely suitable for the implementation of the scheme. But there are popular platforms that support more than two hundred coins — they attract scammers in the first place.

False information about partnerships, investments or technological updates are used to warm up buyers. Paid “experts” are joining the disinformation campaign. The “sensational” information is distributed mainly through Telegram channels. At the same time, most of these channels directly report the pump, promising profit.

After that, investors are confident: since they know about the pump in advance, they will be able to earn. In fact, they are already victims, and some of them even pay for subscriptions to such pump channels.

In the case of a successful advertising campaign, the second wave of the pump begins — third-party investors come who independently influence the growth of the exchange rate. Against the background of the hype, the price is rising, the organizers sell tokens at an inflated cost, after which the cryptocurrency exchange rate returns to its original indicators.

What are the types of Pump & Dump?

Cryptocurrency pumps are divided into long-term and short-term.

- A short-term pump lasts for several hours or even minutes and is used in the case of little-known cryptocurrencies with low capitalization. During the pump, their value soars rapidly, holds positions for a few seconds, after which it falls just as quickly. The financial costs of the organizers of such a pump are relatively low — the “pumping” of the course costs an average of 50 – 60 watts.

- Cryptocurrencies from the top twenty are selected for a long-term pump. As a rule, it lasts for several days, and the ups and downs of the course occur in several stages. Organizing a pump of large cryptocurrencies requires significant financial costs, so large players or communities of traders are engaged in this.

What are the distinguishing features of Pump & Dump?

- The revival of stock market activity (the appearance of large buy and sell orders) and the growth of the exchange rate in the absence of positive news;

- The lack of similar price growth on other exchanges where cryptocurrency is traded;

- An active cryptocurrency advertising campaign in stock exchange chats, forums, social networks and/or Telegram channels.

Is it possible to make money on the Pump & Dump scheme?

It is almost impossible to make money on a short-term pump: profit is possible only for the organizers, ordinary traders simply do not have time to react.

It is theoretically possible to make money on a long-term pump: a trader can count on profit, however, in this case he has only a few minutes to place an order. Moreover, the probability of losses is equal to the probability of profit.

Most pumps have one predictable feature: after the first collapse, a new short-term growth occurs due to the fact that retail investors are involved in trading. After a trader sells tokens at a loss during the collapse, he can buy them at a minimum and sell them during the second rise.

In no case can you buy coins during the second rise – this is a guaranteed loss. Secondary price peaks are typical only for fairly large coins with a capitalization of at least one million dollars.

Pump & Dump Examples

Parallel Coin

On the eve of November 5, 2019, the price of the ParallelCoin token increased several thousand times in a matter of hours (from $1.50 to more than $ 2,000), which gave users the opportunity to talk about the emergence of a “new bitcoin”. A few hours later, the price returned to the $2 level.

The increase in the price of the LINK token was preceded by messages on Twitter about cooperation: On June 13, 2019, Chainlink announced a partnership with Google Cloud, which confirmed this information. After that, the price of the LINK token increased from $1.19 to $1.93.

On June 26, Chainlink announced that it had included the token in the Coinbase listing, after which the price of the token rose to $ 2.24. On June 28, a pump began: several addresses bought large amounts of LINK on Binance, after which they transferred them through a number of fake addresses. By June 29, LINK’s price had risen to $4.45. According to observers, the daily trading volumes of ChainLink on the Binance exchange at the end of June were artificially inflated. Thus, with a capitalization of only $1.4 billion, this figure amounted to $863 million. The price movement chart for the mentioned period, according to some, looked unnatural, especially considering that volumes in favor of sales were recorded on one of the green candlesticks. There was a possibility that unknown people wanted to provoke FOMO, but could not achieve their goal.

On July 2, the dump phase began: addresses that had previously bought tokens began to dump them, after passing them through a chain of fake addresses. Only one of the addresses sold 4.2 million LINK tokens from July 2 to July 15. On the first day of the “dump”, on July 2, the value of the token dropped to $3.73.

On July 6, a recruitment message was posted on the project’s Twitter page, which, according to some observers, indicated a dump. Following this message, a graph was distributed on social networks, which displayed the estimated sales of 700,000 LINK tokens for each price rebound after reaching a peak at the end of June. After going through a small chain of addresses, these tokens were sold on Binance. Some believed that the announcement of the expansion of the staff was just an attempt to hide the large-scale liquidation of tokens.

By July 15, LINK was already worth $2.79, after which the collapse continued. As of September 16, LINK was worth $1.61: the price has almost returned to the level of mid-June.

On February 6, 2018, in a few hours, the price of the little-known E—Coin (ECN) token increased from $6 to $290 – by 4700%. The capitalization of the cryptocurrency has reached $ 1.5 billion. The token entered the top 20 on CoinMarketCap. After that, the price dropped six times during the day – to $45.

Then there was a new round of ECN growth to $228 (400%). The subsequent dump lowered the cost to $5. Then, during the day, the price increased again from $5 to $65 (1200%). At the time of these events, the project did not even have a working website.